Chris Hondros/Getty Images News

Carrier Global Corp (NYSE:CARR) is recognized as one of the world’s largest heating, ventilation, and air cooling (HVAC) companies across a portfolio of commercial and residential brands. While shares have been volatile this year amid the broader market selloff and macro headwinds, we see room to turn bullish ahead of the upcoming Q2 earnings report set for July 28th. We believe the recent headlines of what has been a summer of record temperatures across the Northern Hemisphere likely set up a better-than-expected operating environment into the second half of the year. We like the stock which is supported by overall solid fundamentals and well positioned to rebound higher as it reclaims its long-term growth trajectory.

CARR Key Metrics

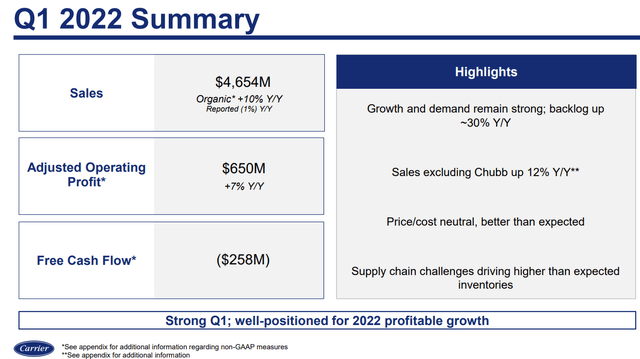

The company last reported its Q1 earnings back in late April with non-GAAP EPS of $0.54 which was $0.07 ahead of estimates. Revenue of $4.7 billion, up 10% year over year organically, was also $100 million above expectations. The story at the time was overall solid demand which was a continuation of the momentum from 2021, with the order book particularly strong.

Price hike initiatives helped balance supply chain disruption cost pressures while the company also generated savings following the sale of its “Chubb” Fire & Security Business. The adjusted operating margin improved to 14% from 12.9% in Q1 2021.

source: company IR

In terms of guidance, management expects full-year sales of around $20 billion, representing an increase in the “high single digits” over 2021. The target for adjusted EPS between $2.20 and $2.30, if confirmed, is approximately flat from $2.26 in 2021.

An important theme for the company has been a trend in debt reduction from receiving nearly $2.9 billion in cash from the sale of Chubb. The company ended the quarter with $8.3 billion in long-term debt, down from $9.5 billion at the end of Q4. Cash and equivalents position climbed to $3.6 billion from $3.0 billion over the period. Considering approximately $2.9 billion in EBITDA over the past year, a leverage ratio of around 1.6x highlights the overall solid balance sheet position.

A priority for the company is continued dividend growth and share repurchases through the existing $830 million buyback authorization. CARR stock yields 1.6% based on a quarterly $0.15 per share payout. We view the dividend as well supported by underlying cash flow.

Is CARR A Good Long-Term Investment?

The takeaway here is that the operating trends and financials have been overall strong, despite the weakness in the stock. Shares of CARR are down about 30% year to date and 35% off from its all-time high set last year near $59.00. The context is the company’s cyclical profile against the shifting economic environment. The combination of historically record inflation and rising interest rates has resulted in a weaker global growth outlook and a general reset of valuations compared to the highs of last year for most companies.

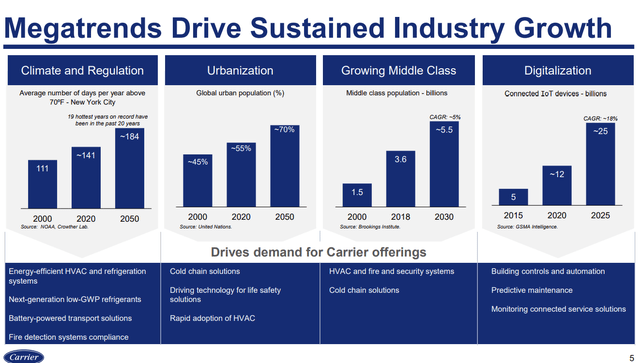

Nevertheless, Carrier sees a combination of “megatrends” driving sustainable industry growth. These include the global climate and regulatory initiatives which support the demand for energy-efficient equipment based on the latest technologies. Separately, urbanization with a growing portion of the world’s population moving to large cities drive rapid adoption of HVAC requirements. This is in the context of a growing middle class, measured in the billions worldwide, that translates into higher HVA and refrigeration solutions, particularly in emerging markets.

source: company IR

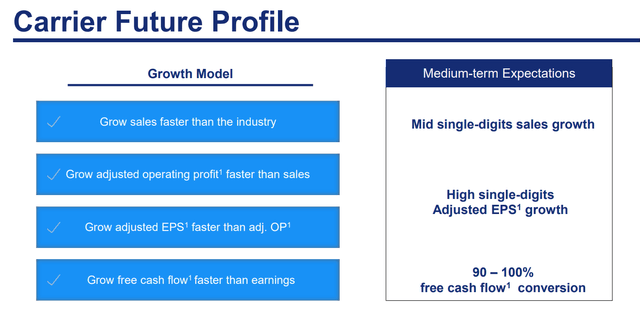

Putting it all together, the outlook is for steady growth as Carrier continues to consolidate market share in key segments. Management expects sales growth in the “mid-single-digits” while adjusted EPS can climb higher into the “high single digits” annually. For investors, this runway can translate into annual dividend growth as another attraction to the stock.

source: company IR

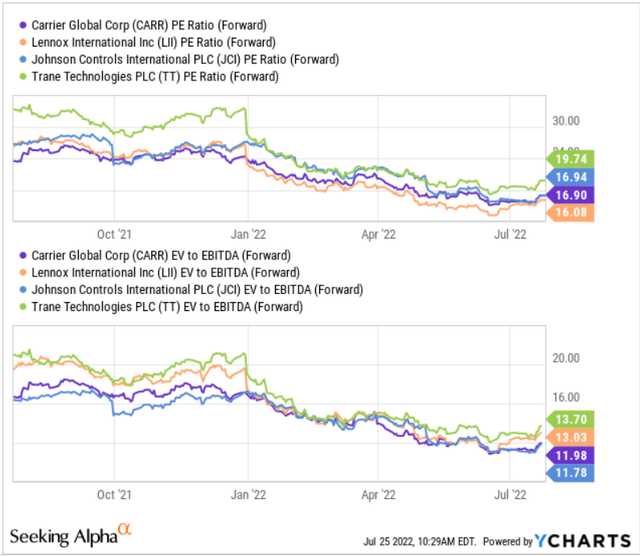

As it relates to valuation, CARR is trading at a forward P/E right around 17x based on the consensus earnings for the full year which is in line with current management guidance. Curiously, a couple of other “HVAC/ refrigeration” stocks including Lennox International Inc (LII), Johnson Controls International PLC (JCI), and Trane Technologies PLC (TT) as a group trade with similar earnings multiples. By this measure, CARR doesn’t necessarily stand out as incredibly undervalued although we believe its quality, including its earnings trend and balance sheet profile, warrants a premium to the group.

While each of these companies has differences, including focusing on various segments, what we like about Carrier is its global diversification. Notably, there is a good geographical mix to operations. Approximately 55% of the business is from the Americas region, followed by EMEA representing around one-third of total sales followed by Asia-Pacific.

source: YCharts

CARR Stock Price Forecast

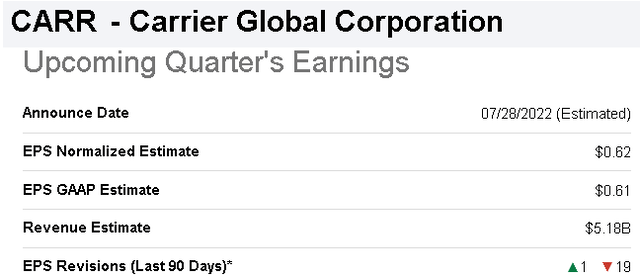

We mentioned CARR is set to report its Q2 earnings at the end of July. The consensus is for EPS of $0.62, which if confirmed, would represent a decline of 4% year over year. This considers what was an exceptionally strong comparison period in Q2 2021 and the recognition of the recent inflationary cost pressures.

Seeking Alpha

The setup here is a generally soft expectation considering 19 revisions lower to the EPS estimate compared to only one increase over the last 90 days. This relative bearishness is reflected in the stock price performance trading lower over the period.

Our take is that a strong number from CARR, including positive management commentary based on current operating trends and demand based on the record heat waves, could be a catalyst for shares to rally higher. Looking at the stock price chart, the $40.00 level appears to be an area of upside resistance although a breakout higher could support continued momentum towards the $50.00 range.

Seeking Alpha

Final Thoughts

We rate CARR as a buy with a price target for the year ahead at $50.00 representing a 22x multiple on the current consensus EPS for 2022 at $2.28. The record summer temperatures further support an underlying demand for the company’s core products beyond near-term macro weaknesses. Ultimately, our call is based on an overall optimistic macro outlook where global growth remains resilient as inflationary pressures cool off going forward.

In terms of risks, a further deterioration of the global growth outlook would likely open the door for another leg lower in the stock. Weaker than expected results would also force a reassessment of the long-term earnings forecast. Monitoring points over the next few quarters include the operating margin and free cash flow trends.